We use internally-developed statistical techniques to arrive at the intrinsic value of ION Geophysical based on analysis of ION Geophysical hews, social hype, general headline patterns, and widely used predictive technical indicators. However, the typical investor usually disagrees with a 'textbook' version of this hypothesis and continually tries to find mispriced stocks to increase returns. This academic statement is a fundamental principle of many financial and investing theories used today. But is it possible? The efficient-market hypothesis suggests that all published stock prices of traded companies, such as ION Geophysical, already reflect all publicly available information. The successful prediction of ION Geophysical stock price could yield a significant profit to investors. When you analyze ION charts, please remember that the event formation may indicate an entry point for a short seller, and look at other indicators across different periods to confirm that a breakdown or reversion is likely to occur. We provide a combination of tools to recognize potential entry and exit points for ION using various technical indicators.

#Io stock price target how to#

SOFI TECHNOLOGIES, INC.ION Geophysical Additional Predictive ModulesMost predictive techniques to examine ION price help traders to determine how to time the market. REPORTS SECOND QUARTER 2022 RESULTS Record GAAP and Adjusted Net Revenue for Second Quarter 2022 GAAP Net Revenue of $363 Million Up 57% $356 Million Record Adjusted Net Revenue Up 50% Year-over-Year Adjusted EBITDA of $20 Mi REPORTS THIRD QUARTER 2022 RESULTS Record GAAP and Adjusted Net Revenue for Third Quarter 2022 GAAP Net Revenue of $424 Million Up 56% $419 Million Adjusted Net Revenue Up 51% Year-over-Year Record Adjusted EBITDA of $44 MillĪmended and Restated 2021 Stock Option and Incentive Plan and forms of agreement thereunder

#Io stock price target full#

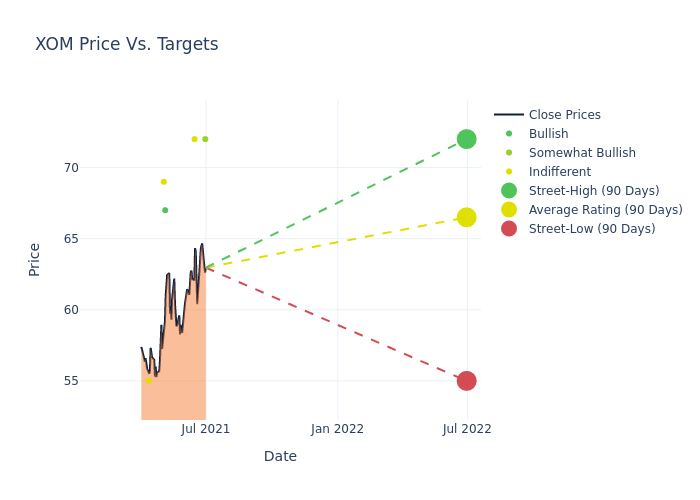

REPORTS FOURTH QUARTER AND FISCAL YEAR 2022 RESULTS Record GAAP and Adjusted Net Revenue for Fourth Quarter and Full Year 2022 Fourth Quarter $457 Million GAAP Net Revenue Up 60% Year-over-Year $443 Million Adjusted Net Revenįirst Amendment to Stadium Complex Cornerstone Naming Rights and Sponsorship Agreement REPORTS FIRST QUARTER 2023 RESULTS Record GAAP and Adjusted Net Revenue for First Quarter 2023 GAAP Net Revenue of $472 Million Up 43% $460 Million Adjusted Net Revenue Up 43% Year-over-Year Record Adjusted EBITDA of $76 Mill Offer Letter, dated as of July 1, 2019, by and between Social Finance, Inc. Offer Letter, dated as of April 21, 2022, by and between Social Finance, Inc. Offer Letter, dated as of June 22, 2021, by and between Social Finance, Inc. , Inc., the lenders party thereto, the issuing banks party thereto and Goldman Sachs Bank USA, as administrative agent REPORTS SECOND QUARTER 2023 RESULTS Record GAAP and Adjusted Net Revenue for Second Quarter 2023 GAAP Net Revenue of $498 Million Up 37% $489 Million Adjusted Net Revenue Up 37% Year-over-Year Record Adjusted EBITDA of $77 Mi This gives investors a broader sense of the overall sentiment for that stock. Price Target Last Issued JThe Trend in the Analyst Price Target IO's average price target has moved down 4.4 over the prior 29 weeks. The ION stock price prediction module provides an analysis of price elasticity to changes in media outlook on ION Geophysical over a specific investment horizon. The average rating of each individual analyst’s rating is the consensus rating for a stock. ION GEOPHYSICAL CORP (IO) Price Targets From Analysts The tables below show price targets and recommendations from analysts covering ION GEOPHYSICAL CORP. The opposite is true when a stock receives a downgrade. It could also mean they believe the market is underestimating the company’s potential.

When an analyst upgrades a stock, they are signaling that the company’s fundamentals are being undervalued by investors. the S&P 500).Īny of these ratings conveys an analyst’s belief that the stock is likely to perform in line with a market index.Īny of these ratings suggest that an analyst believes the stock is likely to underperform a market index. The standard analyst ratings are generally as follows:Īny of these ratings conveys an analyst’s belief that the stock is likely to outperform a market index (e.g. An analyst rating is a classification that gives investors a sense of analyst sentiment about the direction and performance of an equity - usually a stock - over a period of time, typically 12 months. This card shows analyst upgrades/downgrades for SOFI / SoFi Technologies Inc.

0 kommentar(er)

0 kommentar(er)